Managing finances is a crucial part of running any business, but it can also be a time-consuming task. When companies rely on separate software for payroll and accounting, managing data, ensuring accuracy, and staying compliant become even more complex. Fortunately, integrating Zoho Books with Zoho Payroll Management makes the process smoother and more efficient.

Why Integration Matters

In today’s fast-paced business world, automating and streamlining tasks is essential to staying competitive. Manual processes increase the likelihood of errors, especially when transferring payroll data into accounting systems. By using Zoho Payroll Integration, businesses can eliminate these risks and ensure financial accuracy.

When Zoho Books is integrated with Zoho Payroll, the payroll data, such as employee salaries, bonuses, and deductions, automatically syncs with your accounting system. This means you no longer need to enter information manually.

Benefits of Zoho Books and Zoho Payroll Integration

- Automatic Data Syncing

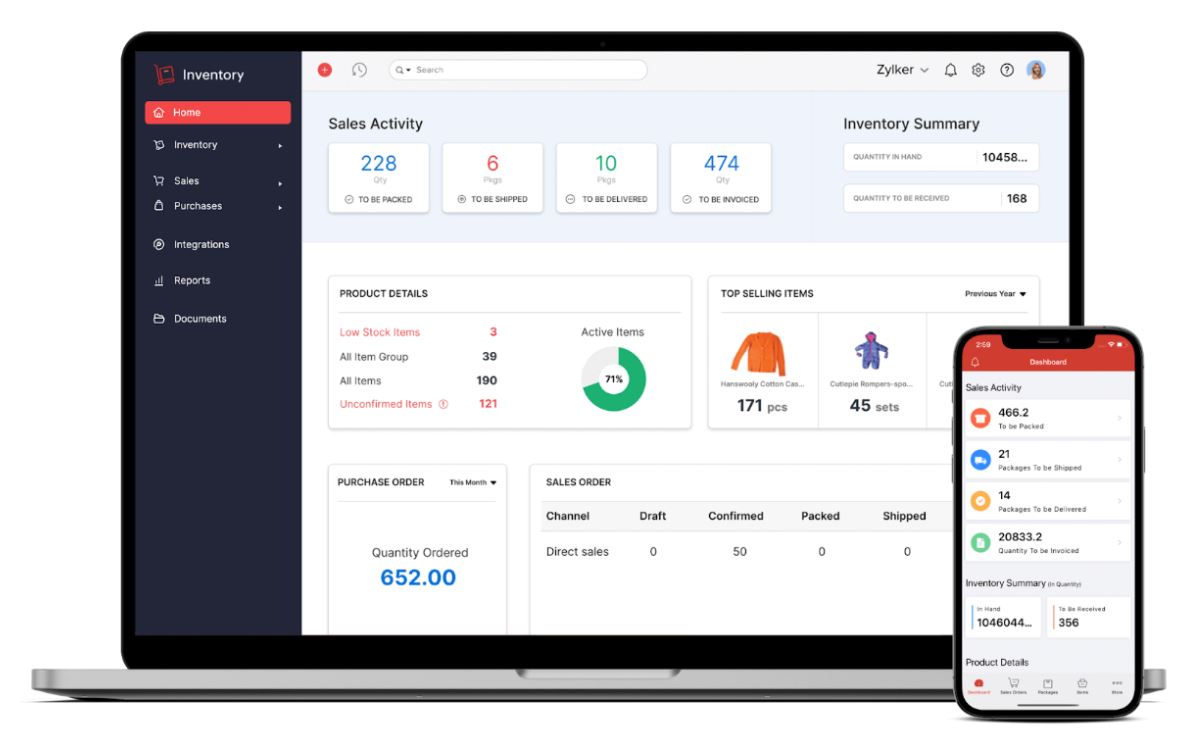

One of the key benefits of Zoho Payroll Integration with Zoho Books is automatic data syncing. As soon as payroll is processed, the data is immediately reflected in Zoho Books. There is no need to manually input numbers or double-check for mistakes. This ensures that your financial records are always up-to-date and your business stays compliant with tax regulations. - Better Financial Reporting

Having your payroll data in sync with your accounting system improves financial reporting. When you have access to real-time data, it’s easier to generate accurate reports that reflect the current financial status of the company. This helps in budgeting, forecasting, and making informed financial decisions. Plus, Zoho Books provides customizable reports that can show insights into payroll expenses, labor costs, and more. - Tax Compliance Made Easy

Payroll taxes can be a headache for any business. By integrating Zoho Payroll with Zoho Books, you ensure that all payroll-related taxes are properly tracked and recorded. This reduces the chances of errors when it comes to filing taxes. Zoho’s system automatically calculates tax deductions. The integration ensures these figures are correctly recorded in your accounting books. - Simplified Expense Tracking

Payroll isn’t just about salaries. It also involves tracking expenses like employee benefits, bonuses, reimbursements, and other related costs. By syncing payroll with your accounting system, all these expenses are automatically categorized and reflected in your financial records. This makes it easier to monitor where your money is going and ensures that no hidden costs slip through the cracks. - Improved Cash Flow Management

One of the key challenges for any business is managing cash flow. By integrating Zoho Books and Zoho Payroll, you can easily monitor your payroll expenses and better forecast your company’s cash flow. With up-to-date financial records, you’ll be able to plan for upcoming payroll payments. It ensures that your business always has enough funds to cover them.

How to Integrate Zoho Books with Zoho Payroll

Setting up the integration between Zoho Books and Zoho Payroll is straightforward. Here’s a quick guide to help you get started:

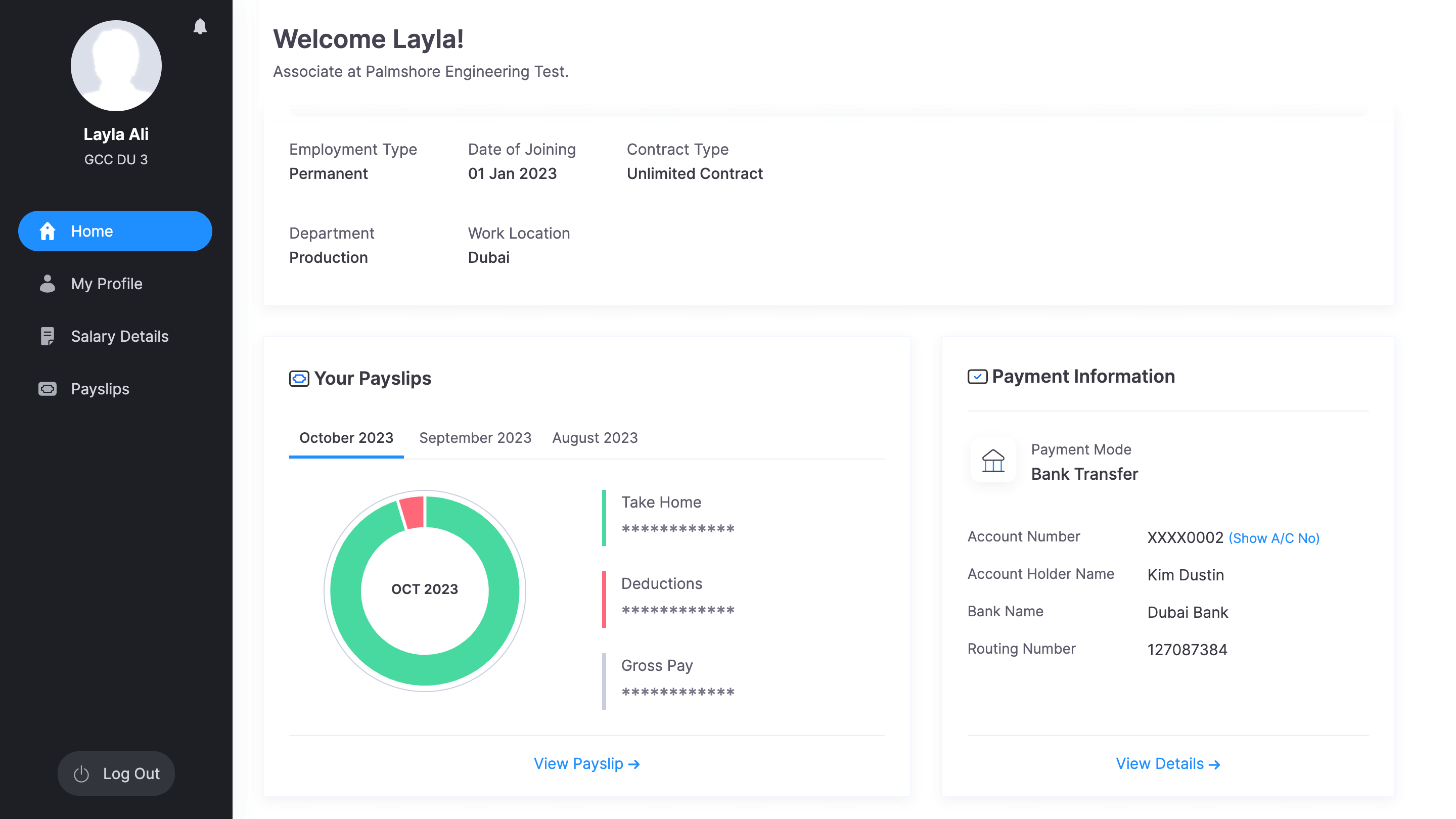

- Sign into Zoho Books and Zoho Payroll

Before you begin the integration, ensure you have accounts in both Zoho Books and Zoho Payroll. You’ll also need administrator access to set up the integration. - Access the Integration Settings

In Zoho Books, navigate to the integration settings. Here, you’ll find the option to connect Zoho One Payroll. Select this option and follow the prompts to authorize the connection. - Configure the Payroll Accounts

Once the integration is established, you’ll need to configure the payroll accounts in Zoho Books. This involves mapping the payroll categories, such as salaries, taxes, and benefits, to the appropriate accounts in your chart of accounts. Zoho will guide you through this setup. - Sync Payroll Data

After configuring your accounts, you’re ready to start synchronizing payroll data. Once your payroll is processed in Zoho Payroll, it will automatically sync with Zoho Books, updating your financial records instantly. - Monitor and Review

It’s always a good idea to monitor your financial records after syncing the data. Zoho Books provides detailed reports and insights into your payroll expenses, making it easy to review and ensure everything is recorded correctly.

Integration for Small and Large Businesses

Whether you’re running a small business or managing a large enterprise, integrating Zoho Books with Zoho Payroll offers tremendous benefits. For small businesses, it eliminates the need for a separate payroll and accounting team, cutting down on administrative costs. Larger companies, on the other hand, benefit from having streamlined processes that save time and reduce human errors.

By integrating payroll and accounting functions, businesses of all sizes can improve efficiency and better manage their finances. This is particularly important for growing companies that need to scale their operations quickly.

Final Thoughts on Streamlining Payroll and Accounting

Zoho Books and Zoho Payroll integration offers a powerful solution for businesses looking to streamline their financial operations. From reducing manual tasks to improving financial reporting and ensuring compliance, this integration simplifies the entire payroll and accounting process. You can get this done with the help of Zoho Partner.

With features like automatic data syncing, real-time financial updates, and tax compliance tracking, businesses can save valuable time and focus on other core areas. Transitioning to an integrated system can enhance your overall financial management and lead to a more organized, efficient business structure.