A smooth and efficient payroll system ensures that employees are paid on time, tax compliance is maintained, and the business stays organized. To make this process seamless, having a payroll management system with essential features is key.

1. Automated Salary Calculation

Automating salary calculations can save significant time and reduce errors. Manual calculations often lead to mistakes, which can cause issues with employee trust and tax compliance. A good payroll management system should calculate salaries, bonuses, overtime, and deductions automatically. With Zoho Payroll Management, this automation ensures that your payroll process becomes smoother, and human errors are minimized.

2. Tax Compliance and Filing

One of the biggest challenges in payroll management is staying compliant with tax regulations. Missing deadlines or making incorrect tax calculations can lead to penalties. Therefore, your payroll system must be able to automatically calculate and deduct taxes according to local laws.

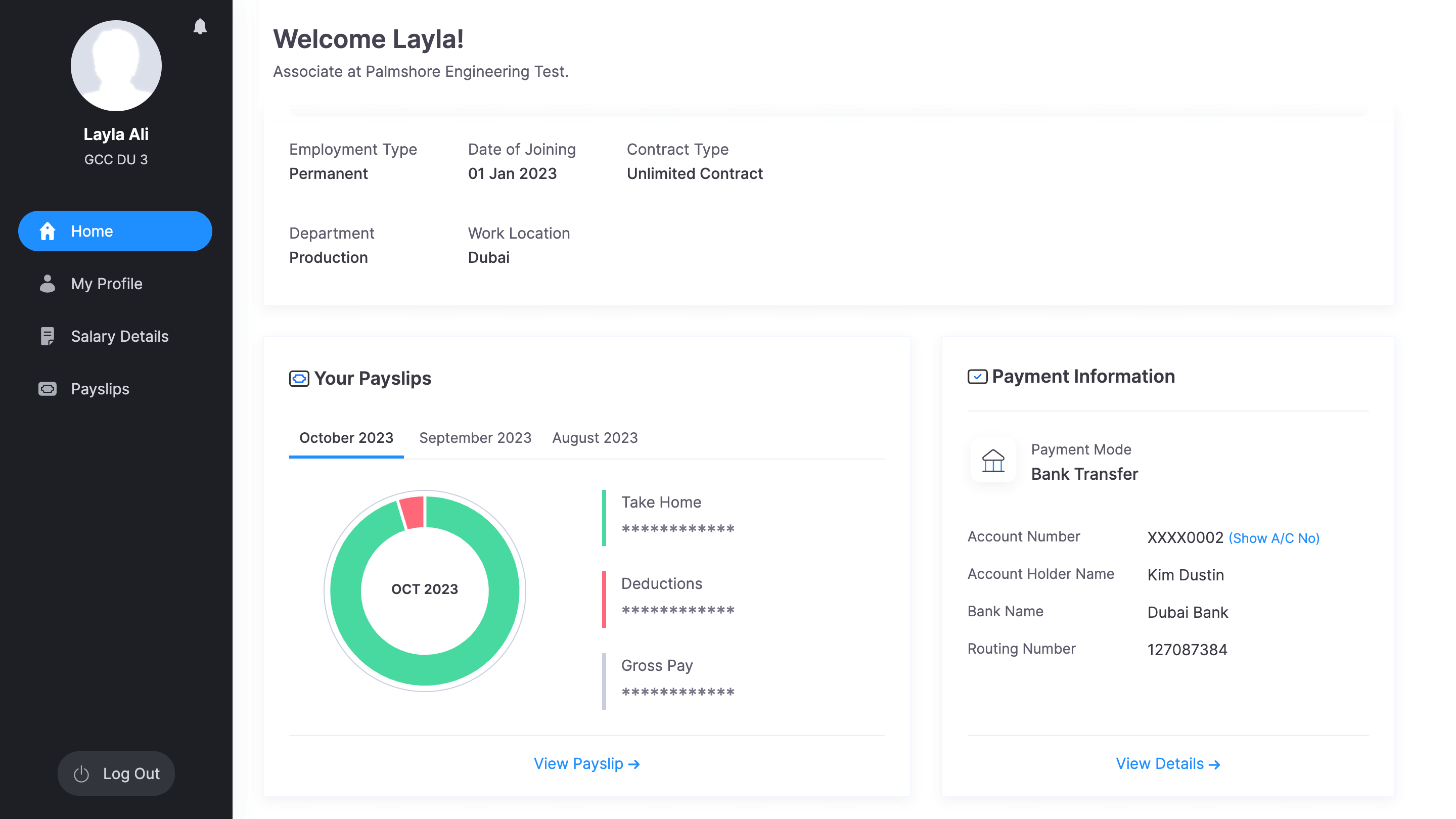

3. Employee Self-Service Portal

An employee self-service portal is a valuable feature that allows employees to access their payroll details at any time. This includes pay slips, tax forms, and attendance records. When employees can view their payroll data independently, it reduces the burden on HR teams. Tools like Zoho One Payroll often offer user-friendly self-service portals where employees can also update their information or submit queries, making communication smoother.

4. Customizable Payroll Structures

Every company has unique payroll needs. Whether it’s different salary structures for various employee groups or specific allowances and bonuses, your payroll system should be flexible enough to accommodate all of these. A customizable payroll structure allows you to tailor the system according to your company’s needs.

5. Accurate Leave and Attendance Tracking

Tracking leave and attendance is essential for accurate payroll management. Miscalculating employee leaves can lead to payment discrepancies. Therefore, your payroll system must integrate with an attendance tracking tool that logs employee hours, tracks leave balances, and calculates wages accordingly. For example, systems like Zoho One Payroll integrate leave management into their platform to ensure everything is recorded in real-time.

6. Direct Bank Transfers

One of the primary tasks of any payroll system is ensuring employees are paid on time. Offering direct bank transfers as part of your payroll system enhances convenience for both employers and employees. This feature not only ensures that employees get their salaries directly into their bank accounts. Also eliminates the need for manual processes like writing checks.

7. Data Security and Compliance

Handling payroll means dealing with sensitive employee information, such as social security numbers, salaries, and tax details. Therefore, your payroll management system should have robust security measures to protect this data from breaches or unauthorized access. A cloud-based solution like Zoho One provides secure access to payroll data while ensuring compliance with data protection regulations.

8. Detailed Payroll Reporting

Payroll reporting is essential for maintaining financial transparency in any business. A strong payroll system should allow you to generate comprehensive reports on employee costs, payroll taxes, and other related metrics. These reports provide valuable insights that help with budgeting, forecasting, and compliance checks. Automated reports can also simplify the auditing process and make it easier to monitor payroll expenses.

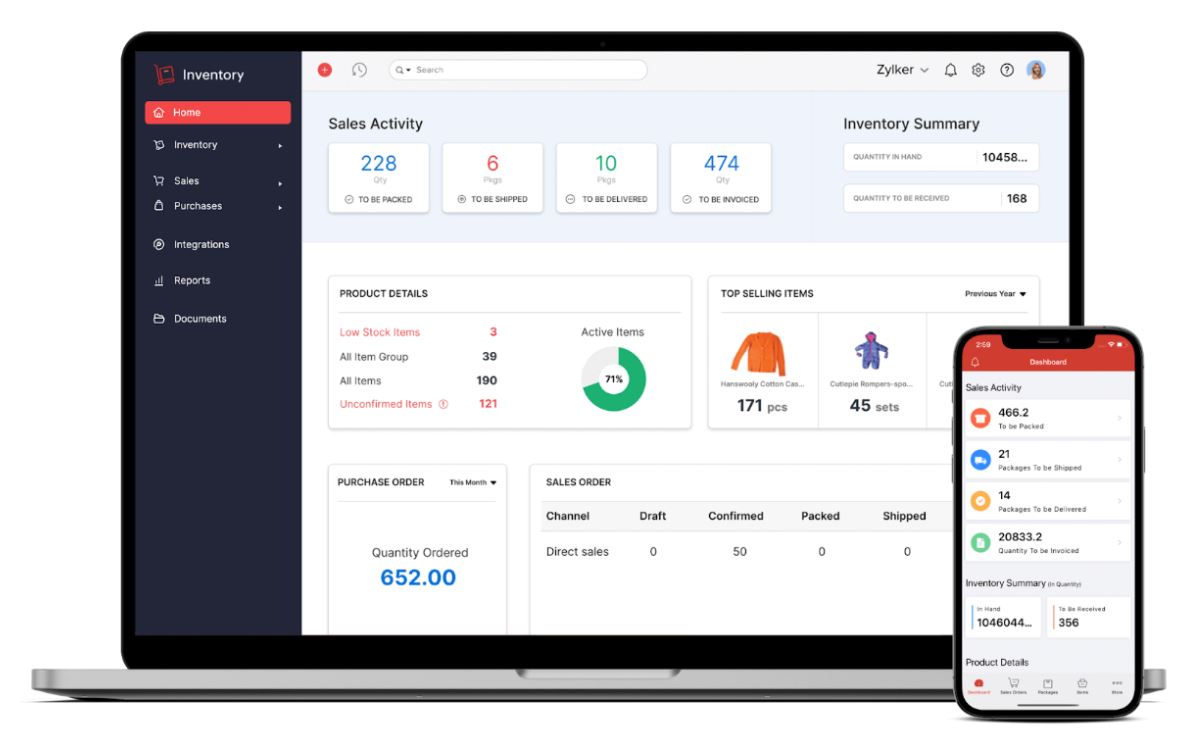

9. Integration with Accounting Systems

To streamline operations, your payroll system should be able to integrate with your accounting software. This integration ensures that all payroll expenses are accurately recorded in your financial statements. It also eliminates the need for manual data entry, further reducing the risk. of errors. Zoho One easily integrates with accounting systems like Zoho Books, making the entire payroll process more efficient.

10. Mobile Access

In today’s fast-paced world, having mobile access to your payroll system is incredibly useful. A payroll system that is mobile-friendly allows HR managers and business owners to manage payroll on the go. Whether you need to approve leaves, generate payroll reports, or handle employee queries, mobile access provides flexibility and saves time.

11. User-Friendly Interface

A payroll system with a complicated interface can slow down your operations and frustrate your HR team. Therefore, it’s important to choose a system that is easy to navigate and user-friendly. A simple yet powerful interface ensures that employees and administrators can handle tasks efficiently with minimal training.

12. Easy Integration with Benefits Management

Employee benefits, such as health insurance, retirement funds, or other allowances, are an important aspect of payroll. Your system should seamlessly integrate benefits management to ensure that the right amounts are deducted and contributions are calculated properly. This feature also provides clarity to employees regarding the benefits they receive and makes record-keeping easier.

13. Scalability

As your business grows, so will your payroll needs. Therefore, a scalable payroll system is essential. You need a solution that can handle an increasing number of employees, complex payroll structures, and added features like benefits and bonuses. Zoho One Payroll is a scalable solution that grows with your business and adapts to its changing needs.

Final Thoughts

An efficient payroll management system is the backbone of any successful business. By incorporating the right features, such as automation, integration, compliance, and scalability, businesses can streamline their payroll process, reduce errors, and ensure compliance with regulations.