An essential component of managing a business is payroll. It involves calculating, tracking, and disbursing employee salaries and benefits accurately and on time. However, managing payroll manually can be time-consuming and prone to errors. That’s where Zoho Payroll Management comes in.

Zoho Payroll Management is an all-in-one solution that simplifies the process of managing employee payroll. From automating calculations to generating reports, this tool streamlines the entire payroll process, saving you time and reducing the risk of errors.

Automate Calculations with Ease

Manually calculating employee salaries can be tedious and error-prone. In today’s business world, payroll can be a complicated and time-consuming process. However, what if there was a simpler method of handling it? Enter Zoho Payroll Management, a powerful tool designed to simplify payroll tasks. Whether you’re a small business owner or a seasoned HR professional, understanding Zoho Payroll Management can help you streamline your payroll processes.

The Importance of Efficient Payroll Management

Efficient payroll management is crucial for any organization. It ensures employees are paid accurately and on time, boosting morale and productivity. Mistakes in payroll can lead to unhappy employees, legal issues, and financial losses. By using Zoho Payroll Management, businesses can avoid these pitfalls and maintain a smooth payroll process.

Zoho Payroll Management offers automation that minimizes errors and saves time. With its intuitive interface and comprehensive features, even those without extensive payroll experience can manage payroll effectively. It’s a great option for small and medium-sized businesses because of this.

Getting Started with Zoho Payroll Management

Starting with Zoho Payroll Management is straightforward. The initial action entails creating an account. You’ll need to provide basic information about your business, such as your company name, address, and tax information. Once your account is set up, you can start configuring your payroll settings.

Zoho Payroll Management offers a guided setup process that walks you through each step. You’ll need to enter employee details, including their names, addresses, and bank account information. The system also allows you to set up pay schedules, ensuring that employees are paid on time.

Simplifying Tax Management with Zoho Payroll

Managing taxes is one of the most challenging aspects of payroll. Zoho Payroll Management simplifies this process by automatically calculating tax withholdings and generating tax forms. The system stays up-to-date with the latest tax laws, ensuring compliance.

With Zoho Payroll Management, you can easily file tax returns and remit payments. The system generates accurate tax reports that can be submitted to tax authorities. This lowers the possibility of inaccuracy and does away with the requirement for human computations.

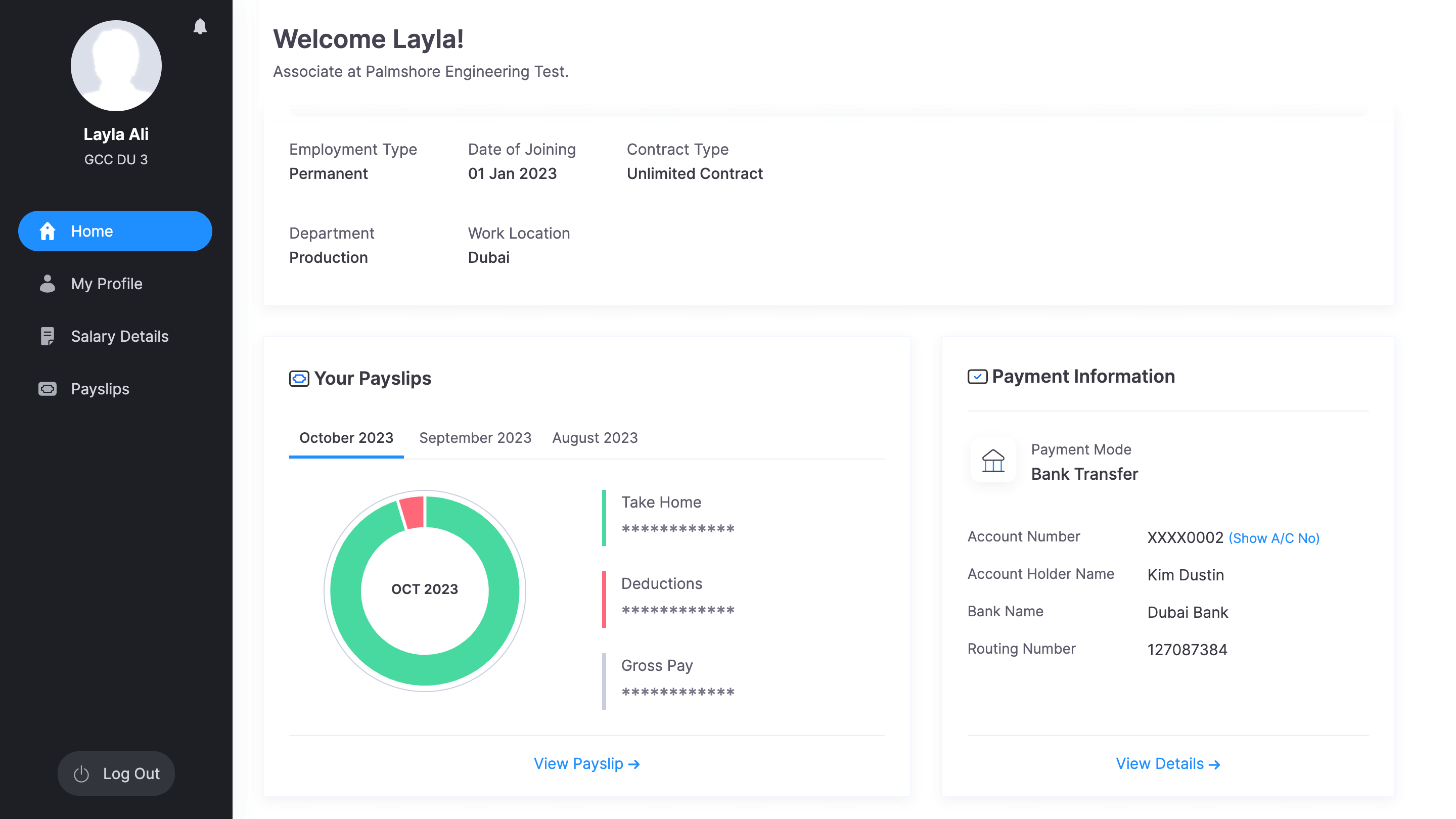

Enhancing Employee Experience with Zoho Payroll

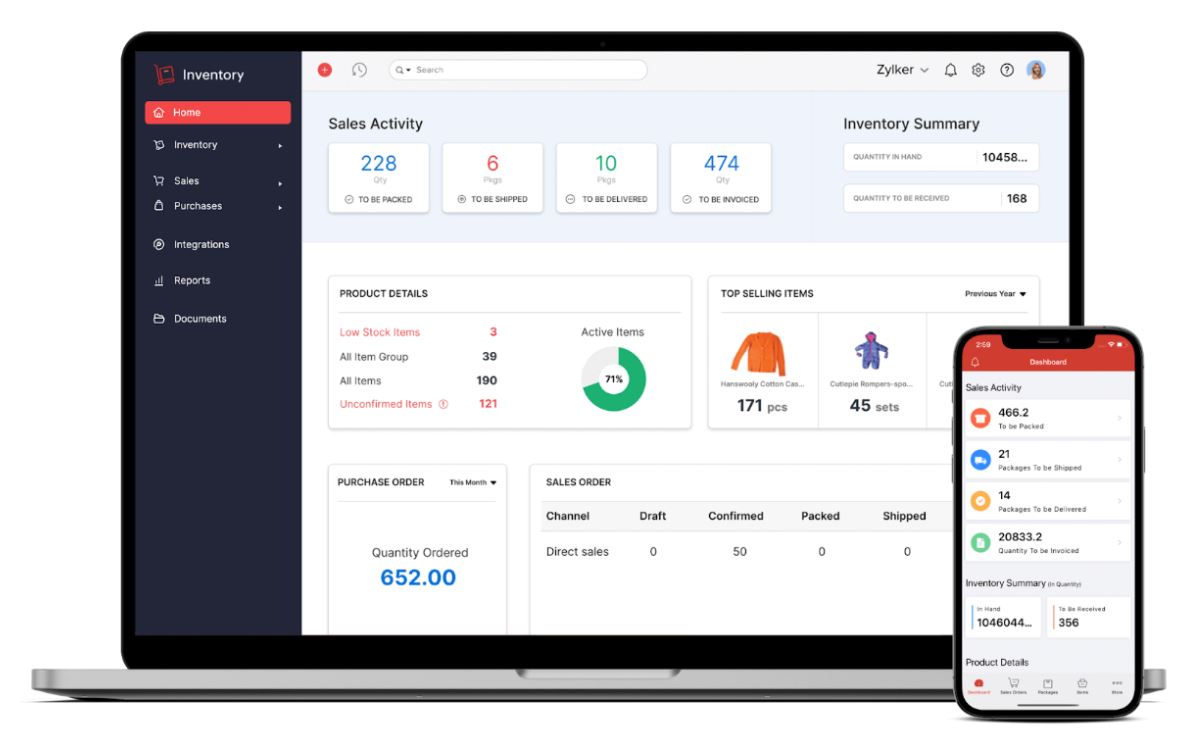

A positive employee experience is essential for retaining top talent. Zoho Payroll Management enhances the employee experience by providing easy access to payslips and tax forms. Employees can log in to the system to view their payslips, check their leave balances, and update their personal information.

The system also offers self-service features that empower employees to manage their own payroll information. This reduces the burden on HR staff and ensures that employee records are always up-to-date.

Streamlining Payroll Processes with Automation

Automation is a game-changer for payroll management. Zoho Payroll Management automates repetitive tasks, such as calculating wages and generating payslips. This lowers the possibility of mistakes while also saving time.

The system also automates tax calculations and filings, ensuring compliance with tax laws. By automating these tasks, Zoho Payroll Management frees up valuable time for HR professionals to focus on more strategic initiatives.

Customizing Payroll Settings to Suit Your Business

Every business is unique, and Zoho Payroll Management recognizes this by offering customizable payroll settings. You can set up different pay schedules, configure leave policies, and define custom deductions. This flexibility ensures that the system meets the specific needs of your business.

Zoho Payroll Management also allows you to create custom reports. You can choose which data fields to include and how the report is formatted. This customization ensures that you get the insights you need to make informed business decisions.

Supporting Compliance with Zoho Payroll Management

For any firm, adherence to tax and labor standards is essential. Zoho Payroll Management helps you stay compliant by automating calculations for wages, taxes, and other deductions. The system stays up-to-date with the latest regulations, ensuring that your payroll processes comply with legal requirements.

Zoho Payroll Management also generates accurate tax forms and reports that can be submitted to tax authorities. This lowers the possibility of inaccuracy and does away with the requirement for human computations.