Zoho books online is an online GST account software program that tracks stock, generates reports, and documents your GST returns on time. Managing the price range in your commercial enterprise is straightforward with this cloud account software. You can also automate your enterprise workflows with the help of Zoho Partner. We allow you to explore all the advantages of using this GST-equipped Zoho accounting software program.

- You can produce customised income orders, estimates, and purchase orders & check in seconds for the image of the logo.

- Manage enterprise connections & unite with group contributors with different user roles and grant them access accordingly.

- Produce and control all income and purchase deals like estimates, deals orders, credit score notes, commercial enterprise freight, bills, supplier credits, and lots more.

- Keep track of your sales duty liabilities.

- Attune your deals & integrate them with your bank accounts.

- Stay informed and alert with distinctive perceptivity, with approximately 50 reports on your business health.

Zoho Books is the best tool for GST compliance, and here’s why ?

You can file GSTR1, GSTR2, and GSTR3 internal Zoho Books with a single click, without having to spend time looking to input offers or fill in paperwork manually. All your earnings and purchase data are routinely despatched to the Government using Zoho books online simultaneously as you validate returns. To help you in making sure that you validate your returns on time, you’ll be notified routinely some days before the fixed deadline every month.

All the deals are recorded in Zoho in keeping with the brand new GST correction, providing an aspect to the enterprise as you may report returns and make payments from a single platform.

Invoicing: Zoho Books presents you with the invoicing installation & it helps to keep a record of deals & guarantees delicacy in data.

Citations Estimates: It facilitates you in furnishing citations & estimates regarding the product or services handled & those citations can be converted into checks with many clicks.

Expenditure Monitoring: Zoho books pricing allows you to import the Receipts of the prices & keep a record of them.

Suggested Read: Quickbooks v/s Zoho Books: A Detailed Analysis

Get an excellent GST account for your enterprise:

Both current and new users can file GST returns in line through Zoho books online by entering their accounts’ GSTIN, username, and starting date. All taxable deals might be mechanically collected from that date by this GST reconciliation software, saving you time and sources.

Auto-select GST for deals:

Associate your contacts with their GSTIN and assign reasonable tax costs to ease your GST go-back filing. Once recorded, Zoho Books will become apprised of the GSTIN and the tax components to be paid and amassed for all the deals you produce with that precise touch.

Classify your Objects Clearly:

Zoho Books helps you to classify your objects as both Goods or Services via coming into their corresponding HSN or SAC codes to ensure the correct taxation. However, if necessary, you may also look for your appliances’ HSN or SAC law using Zoho Books.

INDUSTRIES SERVED USING ZOHO BOOKS:

Restaurant:

- Item operation with functions of price table & force control

- KOT to manipulate your table orders

- Connections control

- Mobile programs for order taking

- Dine in, exclude, Online & feeding categorization

- GST biddable

- Integrating Operation with delivery partners

- Customised dashboard for Operation

- Integrating SMS & Feedback gateway

Retail :

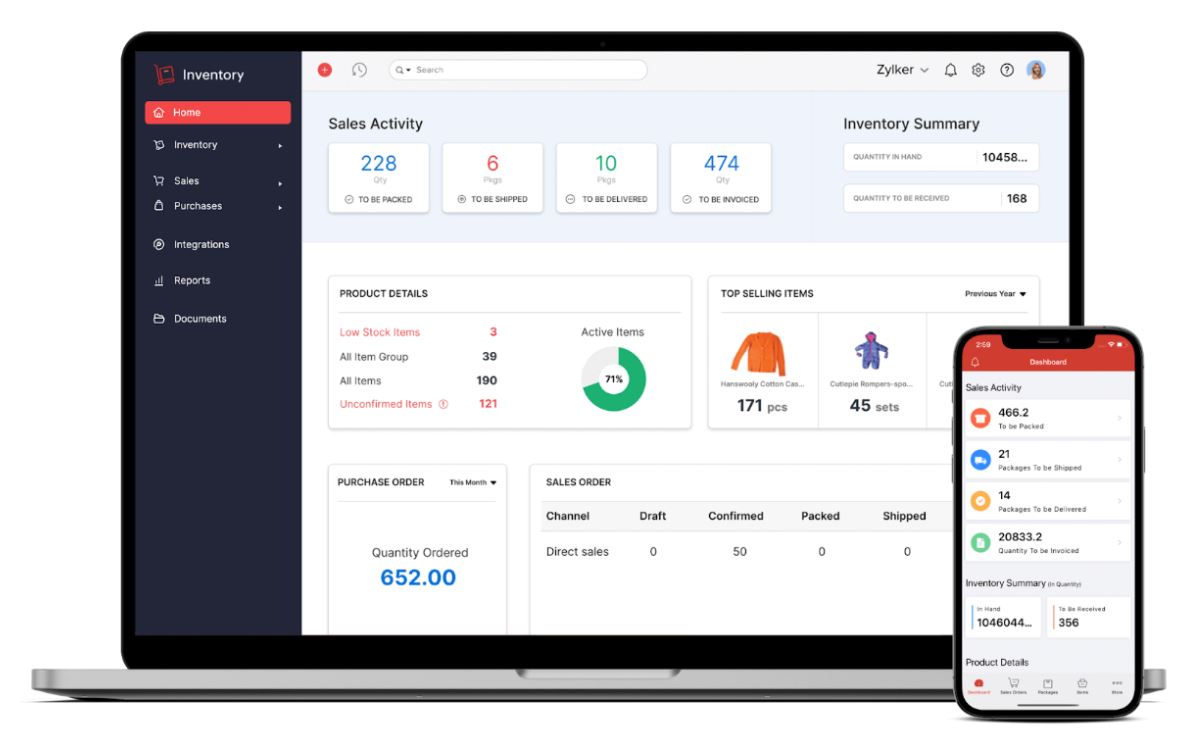

- Account & force control in a single region

- Destruction & Pilferage management

- Retail & Whole trade categorization

- Commission Pursuing Tradesman

- Integration with E-Commerce portal

- Slated & on-demand report period

Many Other Businesses:

- Invoicing, Bookkeeping, Accounting & Reporting.

- Setting up a customer portal to empower guests to view their Deals in unattached regions.

- Banking Integration to manage Banking & Accounting characteristics.

- GST bidable results.

- Automating business workflows to encourage possessors that specialise in their commercial enterprise.

- Integration with SMS Platform for offers and loyalty programs.

- Mobile apps have complete command of marketable enterprise affairs.

Features and Benefits of ZOHO Books Account:

Task Management:

- Keep track for hours. Do time- logging for every running hour.

- Option to apply the timekeeper tool to check the time you spend.

- Maintain a part of multiple enterprises.

- Customised consumers get the right of entry and function to get admission. Limit your user.

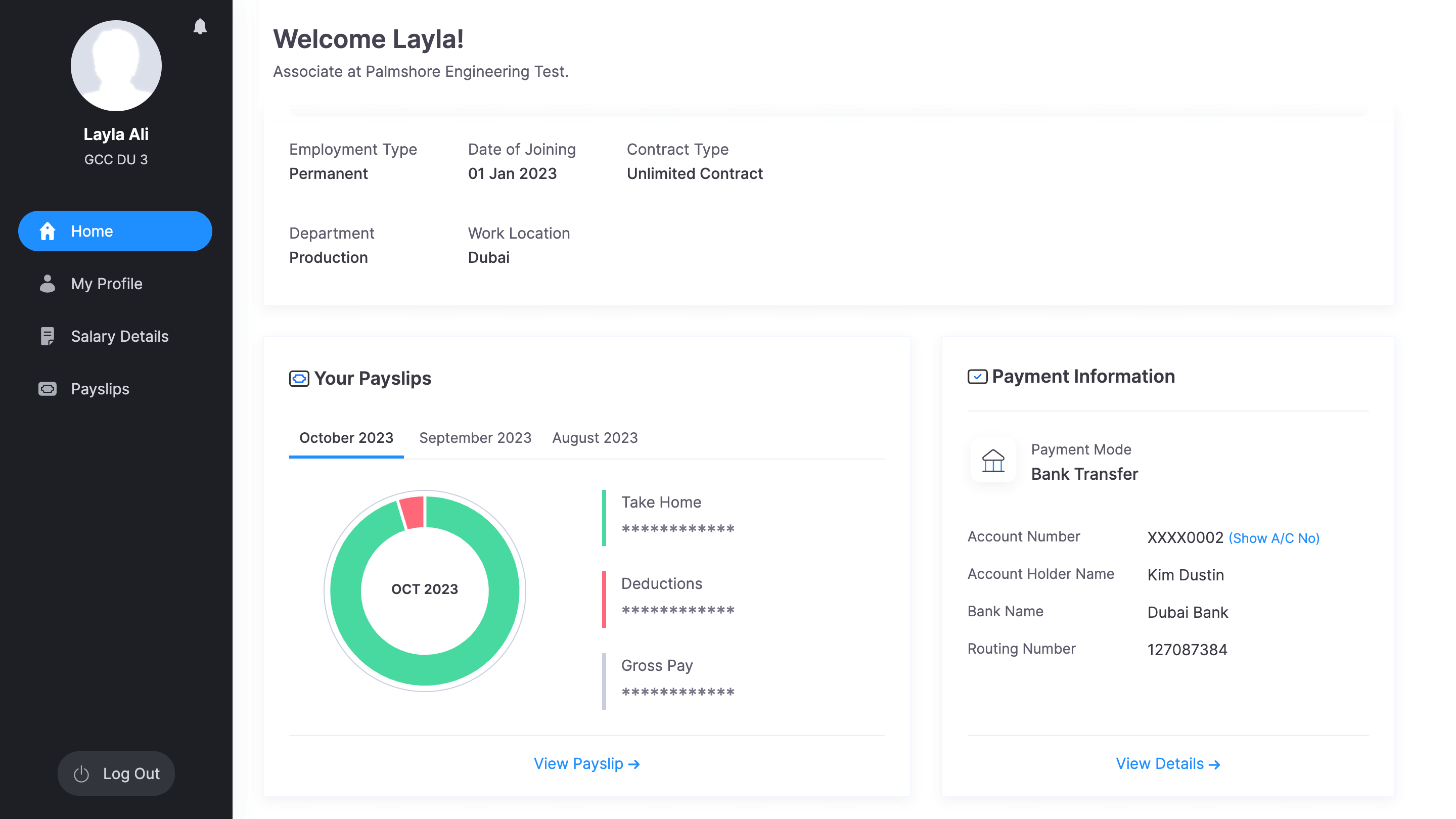

Customer Portal:

- Speed up the featured approval procedure.

- Allow your consumer to pay partial & bulk bills with a click.

- The customer portal keeps copies of checks, estimates, and venture words.

- Get notified while customers view, accept, decline, reflect, or make payments.

- Clients can download and publish beyond deals.

- They can replace their private data.

Banking:

- Connect and key your bank bills in minutes.

- Connect, import, and conform

- Stay updated with your bank accounts.

- Put categorization on autopilot

- Expedite deal matching

- Proceeding fast in bulk

Conclusion:

Zoho Books is constructed to handle GST calculations for you. You can install one-of-a-kind GST costs applicable to your commercial enterprise, have Zoho Books calculate the tax and duty for each trade, and apply it to your tab. It reduces the chances of creating miscalculations in tax computations. Switching to Zoho Books is always a substantial obligation; it prepares you for another change you may need to make on your budget in the future. Subscribe for Zoho Books presently, with loads of evidence of your account.

Abloom is a Zoho Consulting Partner, we help businesses to set up an entire suite of Zoho Apps with our Zoho consulting services.