Zoho Books for Small Businesses: Simplifying Finance Management

In the fast-paced world of small business, efficient finance management can make all the difference between success and struggle. Keeping a record of all the money you earn and spend while ensuring everything is managed correctly is essential. Compliance with tax regulations is a critical aspect that demands precision and accuracy. This blog will explore how Zoho Books adopts “A comprehensive approach to optimize your operations.” to ensure better financial management.

Understanding the Small Business Challenge

Small businesses often need help with limited resources and personnel, and handling finances manually or with essential tools can quickly become overwhelming. Traditional methods like spreadsheets may suffice initially, but they must be more efficient and error-prone as the business grows. Entrepreneurs need a solution that automates routine financial tasks and provides insights to facilitate informed decision-making.

Enter Zoho Books: A Game-Changer for Small Businesses

Zoho Books is a component of the more extensive Zoho suite—applications are known for their user-friendly interfaces and powerful functionalities. Tailored for small businesses, Zoho Books offers a range of features to streamline financial processes, ensuring accuracy, compliance, and, ultimately, peace of mind for business owners.

- Easy Invoicing and Expense Tracking

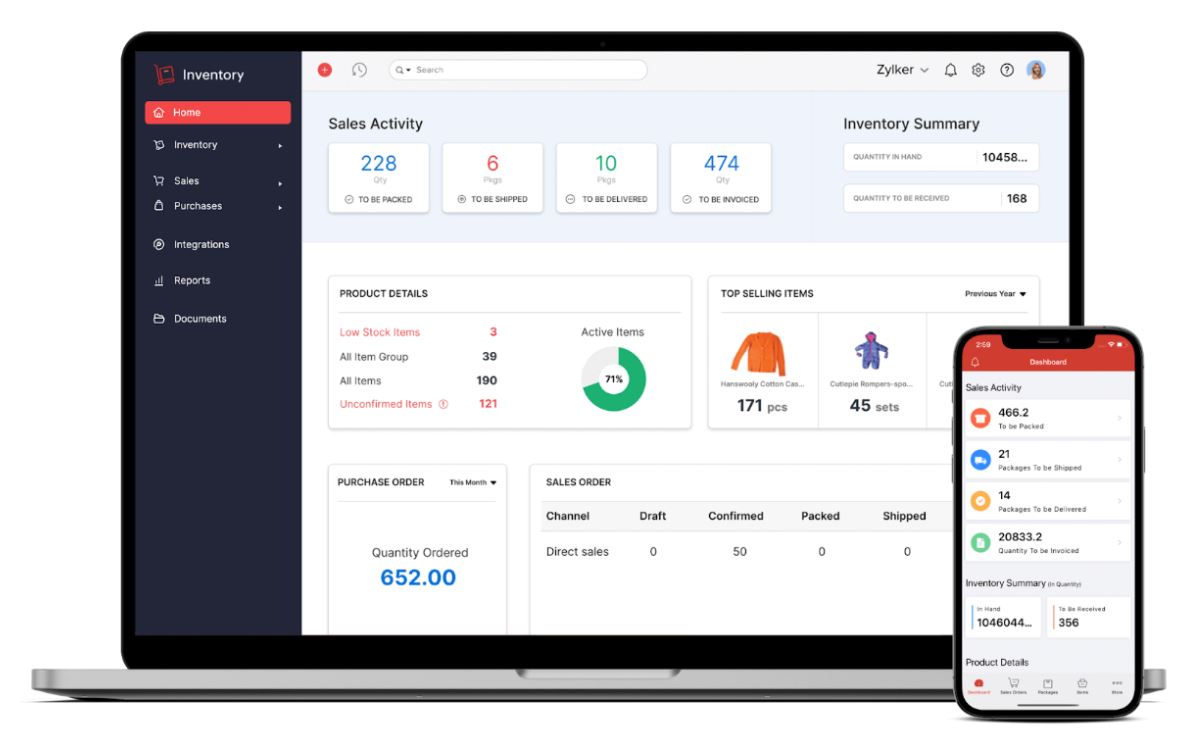

Zoho Books has a prominent attribute that sets it apart: its intuitive invoicing and expense-tracking capabilities. Generating professional invoices is a breeze, allowing businesses to create branded invoices that reflect their identity. The platform supports online payments, making it convenient for clients to settle invoices promptly and improving cash flow for the business.

Expense tracking is simplified with Zoho Books, allowing users to capture receipts, categorize expenses, and monitor spending trends. This ensures accurate bookkeeping and provides valuable insights into where the money goes, helping businesses make informed budgeting and cost control decisions.

- Seamless Integration with Banking

Manual data entry errors can lead to financial discrepancies and save time. Zoho Books integrates seamlessly with bank accounts, credit cards, and other financial institutions, automatically updating transactions and eliminating the risk of making mistakes and saving time. The result of this process can be better utilized for strategic business activities.

Automatic bank reconciliation is a game-changer, ensuring that the financial records in Zoho Books match the actual transactions in the bank statement. This feature is designed to minimize the occurrence of errors. Ensures that the economic data is always up-to-date and accurate.

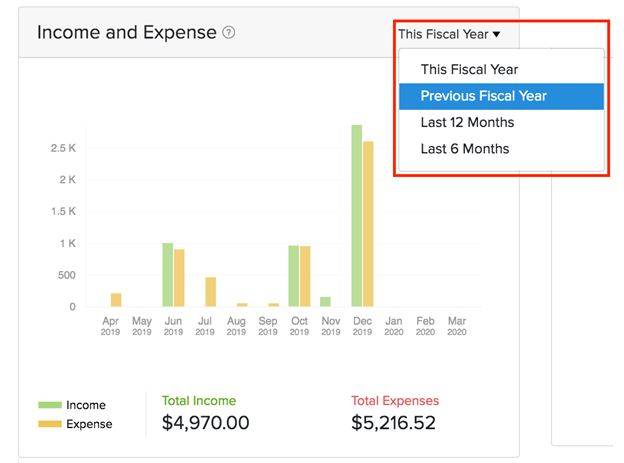

- Robust Reporting and Analytics

Zoho Books offers a variety of reports that can be customized according to your needs—and analytics tools, empowering businesses with the insights they need to make informed decisions. Companies can generate reports tailored to their needs; financial statements include various documents like profit and loss statements and balance sheets, providing an overview of a company’s financial performance. Visual representations of data make it easy to grasp economic trends, enabling proactive decision-making.

This feature is precious during tax season, as Businesses can generate the required reports rapidly and effortlessly. Ensure compliance with tax regulations. Zoho Books makes staying on top of financial obligations easy, reducing the stress and risks associated with tax-related tasks.

- Multi-Currency Support for Global Operation

For businesses operating on a global scale, dealing with multiple currencies can be a headache. Zoho Books simplifies this process by offering multi-currency support. Users can easily create invoices, receive payments, and track expenses in different currencies. This ensures accuracy in financial records and facilitates smoother operations for businesses with international clients or suppliers.

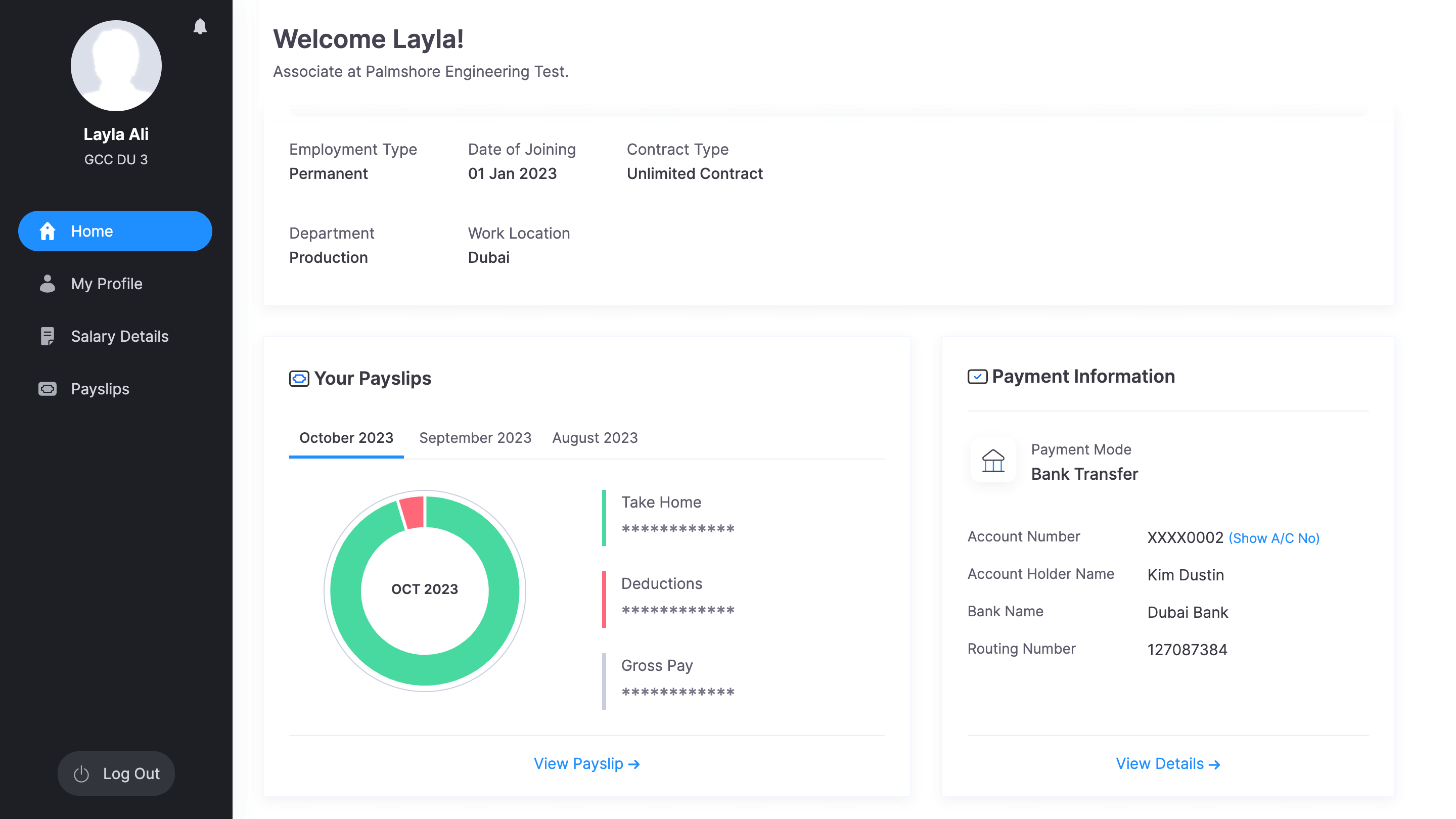

- Secure Cloud-Based Access

Accessing financial data anytime, anywhere, is crucial in the digital age. Zoho Books, a cloud-based solution, allows users to you can securely access your financial information from any device. They are connected to the internet. It enhances convenience and promotes collaboration among team members, accountants, and other stakeholders.

The cloud-based nature of Zoho Books and Regular and secure data backups minimize hardware-related data loss risks. Avoiding failures or other unforeseen circumstances provides businesses with peace of mind regarding the safety and integrity of their financial data.

- User-Friendly Interface and Accessibility

Small business owners often juggle multiple responsibilities; only some are finance experts. Zoho Books understands this and offers a user-friendly interface with a manageable learning curve. The platform provides ample support and resources, including tutorials and customer support, to help users make the most of the platform. This ensures businesses can quickly adopt and integrate Zoho Books into their operations without significant disruptions.

- Compliance and Security: Meeting Regulatory Standards

Staying compliant with tax regulations and ensuring financial data security are paramount concerns for small businesses. Zoho Books addresses these concerns by regularly updating its features to align with the latest regulatory requirements. The platform also employs robust security measures, including data encryption and secure access protocols, to safeguard sensitive financial information.

By entrusting their financial data to Zoho Books, Small businesses can concentrate on their primary operations with the confidence that their accounting processes comply with the latest regulations and that their data is secure from unauthorized access.

- Real-time Collaboration: Facilitating Teamwork

In a collaborative business environment, real-time collaboration is crucial for effective decision-making. Zoho Books facilitates seamless collaboration by allowing multiple users to access the platform simultaneously. This is especially advantageous for companies that have employees working remotely. Teams or various departments handling different aspects of finance.

The collaborative features include role-based access control, ensuring team members have the necessary permissions to perform their tasks without compromising sensitive financial information.

Implementing this approach fosters a culture of openness and responsibility within the company.” it looks grammatically correct and doesn’t contain any spelling or punctuation errors. However, if you want me to rephrase it more transparently, here’s a possible option: “This approach promotes an environment of openness and honesty, where information is shared freely, and everyone is aware of what’s going on.” Responsibility within the organization, where everyone is accountable for their actions and decisions.” This statement highlights the importance of openness and responsibility in an organizational setting.

- Automated Workflows: Boosting efficiency

Automation is a critical feature that sets Zoho Books apart. The platform offers customizable workflows that automate. Performing repetitive tasks can be time-consuming and increase the chances of errors. Automating these tasks can be a great way to save time and reduce the likelihood of mistakes. For instance, businesses can set up automated payment reminders, recurring invoices, and approval processes, ensuring that routine financial tasks are handled efficiently.

This automation enhances efficiency and minimizes the risk of human error, allowing small business owners to focus on strategic aspects of their business rather than get bogged down by manual bookkeeping tasks.

Conclusion:

Zoho Books is a powerful and user-friendly solution for small businesses looking to streamline their finance management processes. From invoicing to expense tracking and bank reconciliation to multi-currency support, the following is a corrected version of the text: “Our platform. “The product provides an extended variety of features.” This sentence clears and lacks context. With additional information, it is clear what the text refers to. Can you provide more details or context? Tailored to meet your specific requirements.” small businesses.

The accessibility and ease of use make Zoho Books an attractive option for entrepreneurs without a finance background. By automating routine tasks and providing insightful reports, Zoho Books empowers businesses to focus on growth and strategic decision-making rather than getting bogged down by financial complexities.

For small businesses aiming to enhance financial control, reduce errors, and improve overall efficiency, Zoho Books emerges as a game-changer in finance. “Management” refers to a software or system with solid and reliable features prioritizing user satisfaction. Satisfaction: Zoho Books is poised to remain a trusted ally for small businesses navigating the intricacies of financial management in today’s competitive landscape.