Zoho Payroll Integration

Zoho Payroll crafted for building a better workplace

Zoho Payroll Integration - the employee portal app is a one-stop solution offering ease of use and unbeatable service. This app allows you to access employee salary details on one go and also view income tax declarations anytime, anywhere. Its key features include: 1. Keeping track of the loans you've received from your employer. 2. Viewing and downloading your Form 16. 3. A certificate issued by your employer. 4. Creating reimbursement claims to receive compensation. 5. Viewing all your salary-related information.

Zoho Payroll experience redefined to be stress-free

Automatic payroll calculation

Run Zoho One Payroll in a few clicks and automatically generate pay-slips online with a thorough breakdown of taxes, allowances, and deductions.

Embrace diverse salary structures

Create multiple pay slabs for your staff, leads, and managers and associate the right template with each employee.

Pay employees on time every time

Transfer employees' salaries directly to their bank accounts with timely online transfers and readily available bank advice.

Straight-forward statutory compliance

Steer your business clear of compliance penalties. We handle your statutory compliance including (PF,PT,ESI,LWF and IT) and make filing easy with tax reports.

Encourage employee self-service

Enable seamless collaboration between employees and your payroll staff and reduce the burden of employee requests.

Fine-grain admin privileges

Invite your qualified staff to process payroll but maintain control with user roles and role-based access.

| zoho consulting partner |

| zoho partner delhi |

| zoho partner mumbai |

| zoho developer |

| zoho consultants |

| zoho crm consultants |

| zoho consultants near me |

| zoho crm developer |

| zoho creator developer |

| zoho implementation partner |

| zoho certified consultant |

| zoho one consultants |

| zoho certified developer |

| zoho crm implementation partners |

| zoho authorized partner |

| zoho software developer |

| zoho implementation consultant |

| zoho app development |

| certified zoho developer |

| zoho programmers |

| zoho developer api |

| zoho developer pricing |

| zoho mobile app development |

| zoho creator app development |

| zoho one developer |

| zoho app developer |

| zoho certified partner |

| zoho web developer |

| zoho books developer |

| zoho development |

| zoho developer support |

| zoho crm development |

| zoho creator certified developer |

| software developer zoho |

| zoho deluge developer |

| certified zoho partner |

| developer zoho com |

| developer zoho crm |

| senior zoho developer |

| software developer in zoho |

| web developer in zoho |

| web developer zoho |

| zoho api php |

| zoho application development |

| zoho business development |

| zoho crm certified partners |

| zoho crm consulting partner |

| zoho crm developer account |

| zoho crm developer api |

| zoho developer account |

| zoho development language |

| zoho development services |

| zoho extension development |

| zoho flutter developer |

| zoho for developers |

| zoho full stack developer |

| zoho hiring software developer |

| zoho ios developer |

| zoho javascript developer |

| zoho mail developer |

| zoho net developer |

| zoho one implementation partner |

| zoho php developer |

| zoho python developer |

| zoho react developer |

| zoho react native |

| zoho software developer 2022 |

| zoho software development |

| zoho sql developer |

| zoho web developer fresher |

| zoho partner new york |

| zoho cosnultants |

We get payroll done so you can get other things done

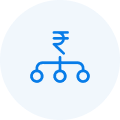

Engage people, not process

Scaling up your business fast? Add your new hires to your payroll in a few simple steps, and manage all their information centrally.

- Administer employees’ information and records.

- Choose how you want to pay your employees.

- Manage your employee exit process.

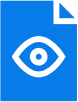

Run payroll in no time

It’s time to turn your payroll chaos into order. Automatic payroll calculations help you to process pay runs without breaking a sweat.

- Systemize your pay schedule.

- Process and approve pay runs in a few steps.

- Accommodate one-time or recurring bonus pay runs.

Keep up with tax regulations

We’ll help you make accurate tax deductions along with tax-ready reports.

- Generate Form 16 for employees to submit income tax returns.

- Incorporate statutory components (PF,ESI,PT, Income tax) as per Indian law.

- Know your year-to-date payroll cost and tax liabilities.