Businesses find that the integration of Zoho Payroll is a crucial tool within the field of remote labour management. It tackles the difficulties in managing payroll for workers who work remotely, guaranteeing efficient procedures and precise remuneration. It’s impossible to exaggerate the importance of Zoho Payroll integration when discussing effective remote labour management.

Companies frequently need help with the intricacies of handling remote employee payroll. There are several obstacles to beat, like keeping track of hours worked, computing taxes in many places, and guaranteeing regulatory compliance. By automating procedures and lowering the margin for error in payroll administration for remote workers, integrating Zoho Payroll simplifies these chores.

Benefits of Zoho Payroll Integration for Remote Workforce Management

There are several advantages to using Zoho Payroll Integration when overseeing foreign staff.

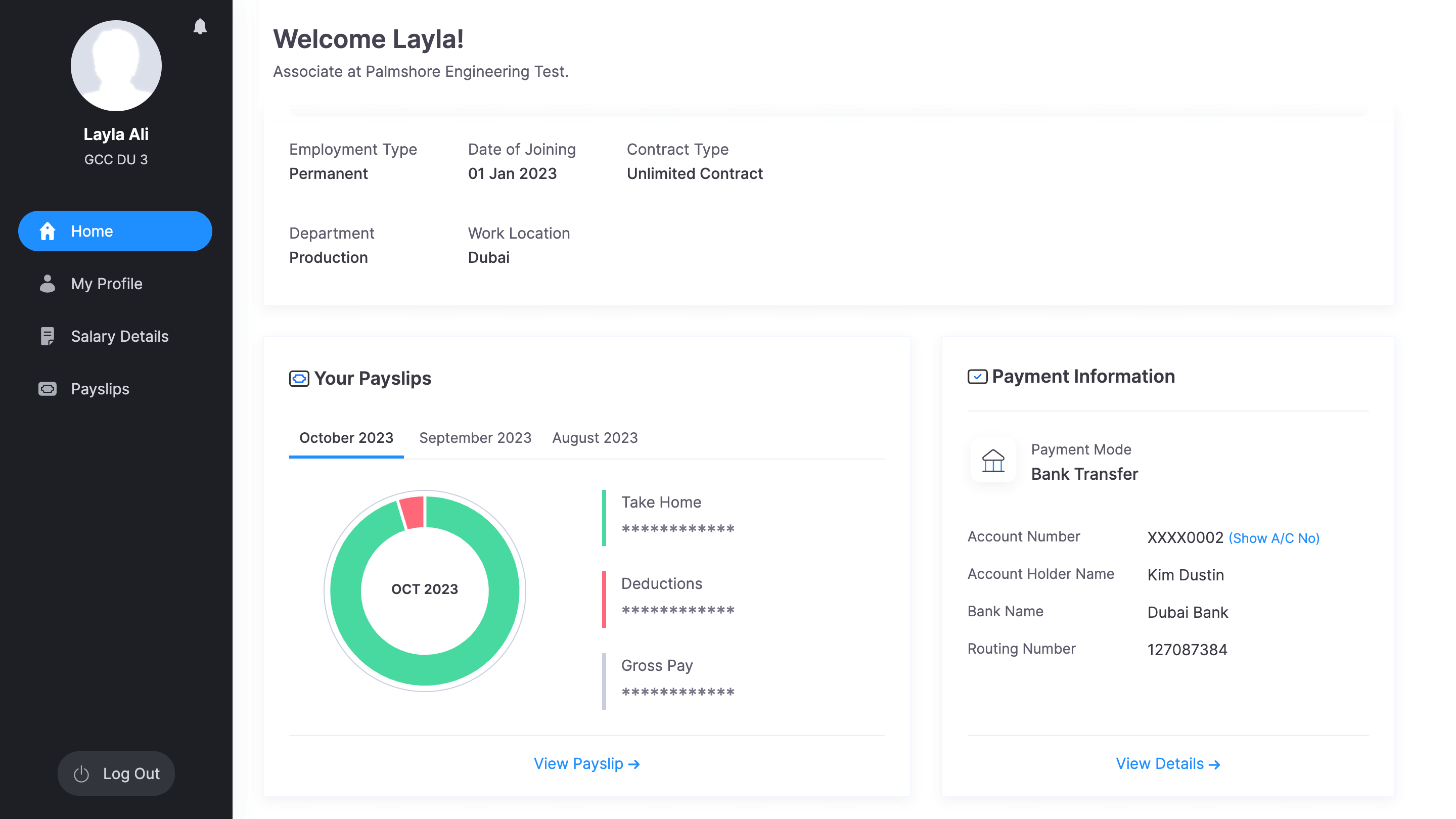

- Payroll automation makes it easier for remote workers to calculate their salary, taxes, and deductions. Streamlining like this lessens the likelihood of mistakes and gives HR departments vital time back.

- Ensuring accurate and timely payments to remote workers is crucial for maintaining trust and motivation within the team. Zoho payroll integration facilitates direct deposits, eliminating delays related to physical checks. Additionally, it allows for straightforward tracking of payment histories, ensuring transparency and accountability in salary disbursements.

- Utilizing Zoho Payroll to manage a foreign workforce can save businesses money. The mixing reduces the necessity for manual data entry, minimizing the danger of human error and, therefore, the associated costs of correcting mistakes. Moreover, by centralizing payroll management, companies can optimize their resources and allocate them more efficiently toward other essential business operations.

Challenges and Solutions

Integrating Zoho Payroll for remote workforce management can present several challenges.

- One common issue is ensuring accurate time tracking for workers working in several time zones. This will cause discrepancies in payroll calculations and employee dissatisfaction. To deal with this challenge, companies can implement a transparent policy on time tracking, use time tracking tools with automatic zone adjustments, and supply training to employees on proper time recording procedures.

- Another challenge in integrating Zoho Payroll for remote workforce management is maintaining data security and confidentiality. With employees accessing payroll information remotely, there’s an increased risk of knowledge breaches and unauthorized access. To mitigate this risk, companies should implement strict access controls, use encryption for sensitive data, and frequently update security protocols to guard payroll information from cyber threats.

- In the event of any issues arising during the mixing process, it’s essential to have an in situ troubleshooting plan. Companies can create a passionate support team to deal with employee queries and technical issues promptly. Offering training sessions for workers on using Zoho Payroll effectively can also help prevent common integration problems. Additionally, companies should regularly review and update their integration processes to ensure smooth operation and address any emerging issues proactively.

Conclusion

When it involves helping organizations navigate the planet of remote worker management, the mixing of Zoho Payroll Integration is revolutionary. It’s a useful gadget due to its capacity to ensure accuracy, streamline payroll procedures, and increase productivity. Incorporating Zoho payroll integration into remote labour management techniques isn’t only advantageous but also necessary to achieve operational excellence.